Non-deliverable forward

FX house of the year, Japan: UBS

Consistency, reliability, technology and range of products across multiple currencies wins UBS the FX house of the year, Japan award

Market weighs viability of spot FX clearing

Supporters believe it could remove credit risks, but others say it would be unnecessary and add costs

Best bank FX liquidity provider: UBS

UBS’s focus on technology, innovation and client requirements wins it the Best bank FX liquidity provider award

SGX launches new Clob for FX spot and NDFs

CurrencyNode to tap into new matching engines in Singapore, and eventually will look to offer futures-spot spreads

XTX Markets set to clear NDFs on ForexClear

Move makes XTX first non-bank liquidity provider to clear NDFs

Best liquidity provider for NDFs and Best algo provider: BNP Paribas

Extension into new markets bagged BNP Paribas two awards at the 2022 FX Markets e-FX awards

India onshore/offshore NDF markets tipped to converge

Local banks will increasingly take advantage of price differentials and close gaps, say market participants

LSEG Singapore NDF platform to gain from EBS London shift

New matching engine could clean up in Asia as rival facility exits Tokyo

Ruble turmoil prompts calls to fix NDF contracts

Some market participants want to see offshore fixings as an option in all standard documentation

Eurex to debut NDF clearing after mothballing physical FX

Bourse hoping to scoop up EU clients trading on 360T, eyes September non-cleared margining deadline

Market braces for end of Russia central bank sanctions carve-out

Isda AGM: general licence expires on May 25, threatening bond payments and deliverable ruble settlement

LSEG to launch new NDF Matching platform in Singapore

Testing for NDF Matching is scheduled for later this year with a full production launch expected in 2023

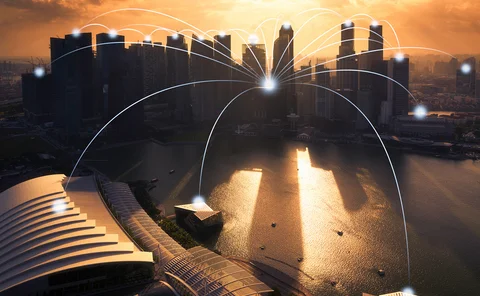

Electronification allows Singapore to take on the world

SG1 data hub enables city-state to consolidate its position as key centre for trading

Offshore waves: how the ruble is becoming a painful trade

As liquidity dries up in markets affected by sanctions, trading is shifting from electronic venues

New FX trading engines power growth for banks in Singapore

Influx of banks setting up electronic matching engines drives trading volumes in city-state

Emta facing calls from FX industry for alternative RUB fixings

Sources also concerned about Ukrainian NDF fixing, which hasn’t changed since invasion began

Ruble fixing conundrum sparks new debate on pricing benchmarks

Uncertainty over Russia-linked hedges raises prospect of a replacement for Moscow Exchange fix

Market braces itself for EBS’s great migration

FX industry prepares for tectonic shift as venue moves to CME Globex

Ruble NDF pricing rupture alarms traders

Conflict sparks big dislocation between ruble NDF and spot, threatening hedges and clouding valuations

Banks, prime brokers and trading venues shun ruble trades

FXPBs turn away derivatives bets as spot platforms block ruble trades and NDF fixings go dark

Traders turn to ruble NDFs to avoid sanctions trouble

Basis between physical and non-deliverable trades hits record high as users shun local currency

Bridging the gap between traditional and digital currency markets

360T explores how traditional solutions from the FX markets can further advance the digital currency space by diversifying its range of participants

FX Markets Best Banks Awards 2021: CME Group and EBS secure wins in three categories

CME Group’s EBS business allowed all-areas access to liquidity at the time market participants craved it most: when the pandemic applied stress and uncertainty to markets and caused great swings in volatility