Liquidity

Guy Debelle on the FX Global Code and the rise of the buy side

Code’s creators considering updates to sections on last look and pre-hedging

Why central banks aren’t worried about FX algos – for now

Disclosure failings have been fed into review of FX code; other risks are profound, but distant, says Andrea Maechler

MAS unveils renminbi funding for banks in Singapore

New funding scheme of up to 25 billion yuan replaces overnight funding facility

How to navigate fragmented NDF liquidity

Liquidity consumers need to embrace dialogue with their LPs as an integral part of the liquidity curation process, argue HSBC execs

Joe Biden’s slow road to remaking US financial regulation

Moves on climate risk could come early; other changes may have to wait until the end of 2021, or later

Big moves, but no panic after tumultuous US election

Treasury market saw its largest post-election move since at least 2000 – but liquidity held up

Unleashing the potential of NDFs

Trading in non-deliverable forwards is on a roll, despite concerns over liquidity

AFM seeks ‘level playing field’ for venues and aggregators

Dutch regulator suggests some liquidity services should be classified as OTFs

Baton to launch payments system for emerging currencies

Fintech company joins efforts to tackle rising settlement risk

Avoiding market impact – it takes two

Dealer hedging practices have a big part to play in quiet execution, but so does client behaviour, writes UBS's Ciara Quinlan

Banks tout early roll dates for FX swaps as quarter-end looms

Asset managers open to more flexible hedging strategies since March turbulence, say dealers

Appetite for renewed Fed dollar swap lines in doubt

With up to $300bn of positions nearing expiry, some say FX swap market can meet banks’ funding needs

Turkey turmoil opens door to offshore NDF market

Emta openly discussing documentation for offshore lira

Choppy markets revive quest for RFQ’s ‘magic number’

Deutsche argues for smaller, stronger panels; Citi offers better prices for 'full amount' trades

BLTs and glitchy Wi-Fi: lockdown life for FX execs

With traders transacting trillions from their living rooms, currency markets are adapting to new normal

Andreas König’s crisis playbook meets Covid-19

Interview: Trading from home may be odd, but Amundi’s FX head was ready for other stresses

Inside March madness with Citi’s Tuchman

Interview: Trading rooms went virtual, central banks stepped up – but some platforms flopped

Investors trade the drama out of the crisis

How LGIM, AXA, Manulife and other buy-siders tackled the toughest markets since 2008

Assessing execution quality and slippage in volatile times

Market participants must focus on how their evaluated execution costs vary in different market regimes, writes Tradefeedr’s Alexei Jiltsov

Forwards spreads fall but won’t hit January levels, say traders

While bid/offers have shrunk since March’s highs, dealers expect them to remain elevated

Market turmoil causes traders to pull back to vanilla strategies

Emerging markets spreads tighten but liquidity still patchy

Charted: rush for dollar liquidity fades

Figures from central bank dollar repo facilities show waning demand, but outstanding swaps still high

NDF access will help tame rupee volatility, say dealers

Lifting of restrictions stopping Indian banks trading rupee NDFs allows RBI to intervene offshore

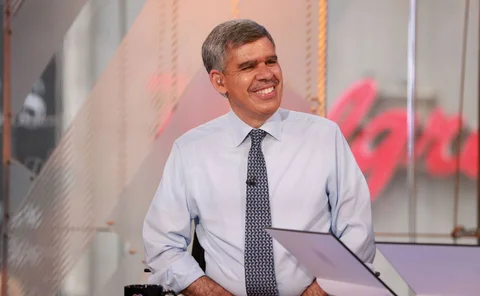

El-Erian on Covid-19 policy risks and ‘zombie’ markets

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load