Monetary Policy

World must prepare for takeoff of renminbi transactions

A more flexible renminbi will inevitably lead to the currency's increasing adoption in daily dealings, says HSBC

Policy divergence to remain a theme for two more years

Some currency pairs could go lower if the Fed's hopes for a rate increase materialise, says Wells Fargo analyst

BoE holds interest rates but hints at action in August

Sterling extends gains as the central bank awaits more economic data from the referendum aftermath

CFETS likely to include won and rand in RMB Index

Following CFETS's approval of direct trading on the interbank FX market, the two currencies could soon be included in the basket directly linked to the renminbi

Renminbi is more flexible and market-based, says IMF

Fund praises the progress made by China's authorities in giving markets greater influence over its currency

House prices complicate outlook as RBNZ holds

Central bank caught between strong New Zealand dollar and rising risks in the housing market; keeps rates on hold

Strong dollar behind economic paradigm breakdown – Shin

BIS head of research points to failure of covered interest parity post-2008, with the strength of the US dollar correlated with the size of market anomalies

Brexit could spur action from the Swiss National Bank

The euro could suffer in the event of Brexit and spark action from the SNB – Swissquote's head of market strategy

Policy divergence is biggest macro risk – reserve managers

Survey of central banks shows monetary policy, negative rates and China are top concerns

Quants: carry and value will work for next six months

Less volatile market conditions look favourable for these strategies

Top central banker defends Indonesia’s hedging requirement

Bank Indonesia’s senior deputy says the country’s $168bn foreign debt burden is safer than it looks

Sterling to head lower as Brexit looms

With three months to go, volatility in sterling is set to rise as uncertainty remains pivotal, says CIBC head of G10 FX strategy

Currency wars set to reignite – Gain

Gain Capital-owned strategist expects to see FX wars return

Betting against central banks still a very dangerous game

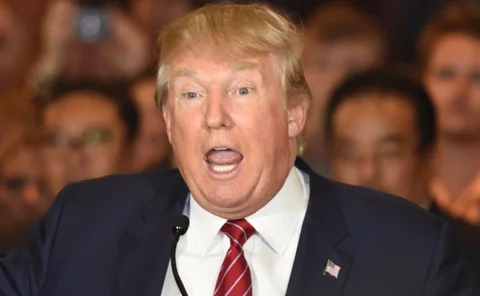

"Dollar appreciation has been stopped in its tracks as markets reassess Fed policy," panellists argue at FX Week Australia

China may introduce Tobin tax on FX transactions

A levy on currency trading could be put in place to fight speculation

ECB unveils fresh stimulus measures

European Central Bank cuts rates to new low and expands QE scheme

Negative rates held for too long could lead to a bank run

Panellists say negative rates could have detrimental effects on the banking sector

Rabobank wins with a close cable call

Jane Foley, senior currency strategist at Rabobank, sees political uncertainty over Brexit as the catalyst for more sterling volatility

PBoC’s Zhou dismisses talk of renminbi devaluation

China’s governor says the country is “opposed” to competitive devaluation and capital outflows are likely to subside

Possibility of global crisis has resurfaced, panellists say

Attention turns from policy normalisation to the threat of global slowdown

Wells Fargo takes top spot with five close calls

The US bank expects another Fed hike towards mid-year

Volatility to be persistently higher as uncertainty rises

But Goldman Sachs Asset Management's head of international market strategy sees recovery in the global economy

Danske Bank bags victory on USD/CHF call

The bank expects the Fed to leave interest rates alone until September

China's FX reserves plunge to more than three-year low

Latest PBoC figures show a drop of $99.5 billion in January to $3.23 trillion