Credit risk

It pays to be selective when choosing clients, say FXPBs

Credit Suisse collapse strained relationships and showed importance of a partnership approach

SA-CCR brings little succour for FX dealers and clients

Spreads on swaps and forwards likely to widen as banks adjust to capital-intensive regime

NatWest’s PB chief on not changing course after Archegos

Marcus Butt believes diversity of clients, both in size and type, is the best way to manage risk

PBs get new help in war on generosity

Big FX venue operators offer way to reduce overallocation of credit

Flexi forwards see rise in corporate interest post-Covid

Treasurers seek flexibility in cashflow hedging as pandemic-related supply chain disruptions bite

FX HedgePool targets Europe as volumes grow

Platform eyes expansion, as swaps volumes hit $1.5 trillion since inception

Deutsche Börse eyes quantum computing

Pilot application to model enterprise risks cuts computation time from 10 years to 30 minutes

Investors eager for next round of China financial reforms

Bond futures and credit default swaps the missing pieces

SA-CCR switch clouded by confusion over netting sets

An effort by US regulators to incentivise the switch to SA-CCR may be having the opposite effect

FX headwinds cancel out HSBC’s Q3 RWAs cut

Portfolio reductions reaped $10.8 billion of RWA savings

Swaps platform aims to cut out the banks – but not entirely

Peer-to-peer newcomer FX HedgePool targets asset managers’ month-end hedging activity

FX swaps clearing redux

SA-CCR could unleash the potential of clearing, and may ignite some big changes

SA-CCR adoption may spur wider FX swaps clearing

With up to 90% lower exposures on offer, dealers say capital benefits could outweigh margin costs

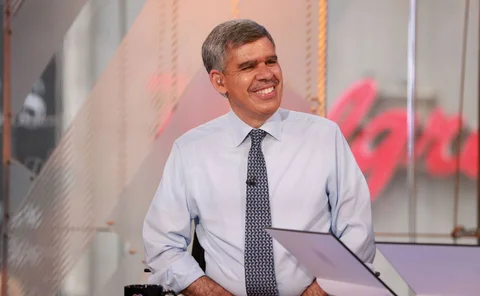

El-Erian on Covid-19 policy risks and ‘zombie’ markets

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Stater Global Markets partners oneZero

The prime-of-prime broker gains access to a network of 200 market-makers and takers

Cobalt unveils credit-management platform

Credit providers can see exposures in real time

Cost of credit no longer about the end-client, panellists say

Instead, it reflects the cost of major participants taking risk amongst themselves due to margin rules

CME Clearing and TriOptima clear first client trades in Mexican peso

Until now, only clearing brokers or FCMs were eligible to use the triReduce service to compress trades

Brexit spurs caution from brokers and platforms

"Nobody in the industry wants a repeat of the SNB, whereby clients suffered heavy losses and effectively became debtors," says ADS Securities' James Watson

Liquidity woes are curbing FX growth

Difficulties in accessing alternative liquidity pools and the rising cost of trading are creating unexploited opportunities

Samsung Securities gains third-party access to CLS

The securities company is the first non-bank financial institution to join CLS in South Korea