Major online brokers publish fall in volumes and revenues

Online brokers FXCM and IG Group are reporting a continuing fall in trading volumes from retail and institutional clients, as low volatility and new regulations affect activity.

New York Stock Exchange-listed FXCM said in its monthly report that trading volume from retail clients was down 11% to $257 billion in December 2012, compared with December 2011. However, average daily trading by retail customers was up 3% to $13.5 billion on December 2011, reflecting the company's strategy of attracting larger customers.

Though a smaller proportion of overall volumes, the broker suffered markedly in its institutional business where trading volume was down 23% in December 2012 to $80 billion compared with December 2011. Average institutional trading volume per day was also down, by 11%, to $4.2 billion compared with December 2011.

"We are pleased with how we have weathered muted foreign exchange markets in 2012, with our overall retail volumes decreasing only 5% to $3.6 trillion despite a 23% decline in average daily volatility to multi-year lows, as measured by the CVIX," said Drew Niv, chief executive in New York. "In particular, in 2012 we were very successful in attracting larger customer accounts, and while its positive effect on our trading volumes was offset by the unfavourable market environment, it positions us well for the future."

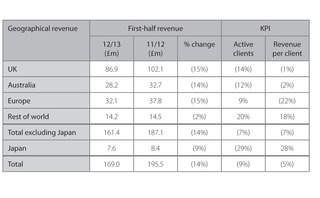

Meanwhile, IG Group said that net trading revenue from financial spread betting had fallen by 13% in the six months to November 30, to £61.544 million compared with the corresponding period of the previous year. Similarly, net trading revenue from contracts-for-differences trading fell by 15.72% to £97.807 million during the first six months of the broker's financial year compared with the corresponding period of 2011.

Net trading revenues from the binaries arm countered the trend by increasing 14.58% to £9.609 million.

"The prior year was marked by extreme volatility in global financial markets, producing particularly strong comparators, which was in stark contrast to the very subdued markets throughout the current period," said Tim Howkins, chief executive at IG Group in London.

Howkins added that factors including central bank intervention, global economic uncertainty and fragile consumer sentiment affected the behaviour of existing and potential clients.

"However, there is nothing to suggest that the weakness in the first half is structural. On the few days in the period when we saw larger market movements, our clients responded accordingly and our revenue on those days was, as would be expected, much higher," he said.

The view was reflected in its established UK and Australian businesses, where only a slight decline in revenue per client was seen.

Outside of Norway and Sweden, which were new markets during the interim period, IG experienced the strongest growth in client numbers from US and South African businesses, while Singapore delivered active client growth of 6%.

Howkins said that its Japanese business was affected by the reductions in leverage limit by the regulators, which fell to 25:1 in August 2011. "Although the regulatory situation [in Japan] remains challenging, we continue to concentrate our efforts on recruiting higher-value clients, which helps explain the strong increase in revenue per client and fall in active client numbers during the period," said Howkins.

FXCM additional data

• Average trades per retail clients up 15% to 409,875 in December 2012, versus same time the previous year.

• Retail customer trading volume for fourth-quarter 2012 was $886 billion, 9% lower than fourth-quarter 2011.

• Volume from indirect sources was 47% of total retail volume in fourth-quarter 2012.

• Retail customer trading volume for full-year 2012 was $3.6 trillion, 5% lower than 2011.

• An average of 11,313 institutional client trades per day in December 2012, 35% lower than December 2011.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact customer services - www.fx-markets.com/static/contact-us, or view our subscription options here: https://subscriptions.fx-markets.com/subscribe

You are currently unable to print this content. Please contact customer services - www.fx-markets.com/static/contact-us to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com

More on Retail

IG research explores correlation between politics and FX data levels

New timeline of global historic politics impacting forex offered online

Esma warns retail brokers over ‘pro’ push

Regulator warns brokers not to promote professional status to unqualified investors

Austria imposes permanent restrictions on CFDs, bans binary options

In making Esma’s curbs on CFDs lasting, the regulation follows action by the Netherlands and others

CMC posts profit warning; Foley resigns

New Esma margin rules have “resulted in retail clients trading less”, online trading firm says

IG opens for online FX trading in US

Retail FX broker launches new subsidiary after navigating regulatory hurdles

Saxo Capital Markets: Esma leverage limits on CFDs good for industry

The policy will reward well-behaved retail FX brokers

FCA mulls restrictions on CFDs

The restrictions are fundamentally similar to those imposed by Esma earlier this year, but would have permanent effect

Asia: the new frontier for global payments

With regulatory barriers lowered, the region is ripe for new entrants