This article was paid for by a contributing third party.

The trend towards best practice in institutional FX settlement

Since its inception in 2002, the merits, usage and popularity of CLS’s settlement service have risen substantially. CLS remains consistent in its original approach – gathering the support and usage of the global bank community to provide a centralised, real-time, payment-versus-payment (PvP) settlement network that allows for streamlined, straight-through processing (STP) and protection from settlement risk for foreign exchange trades.

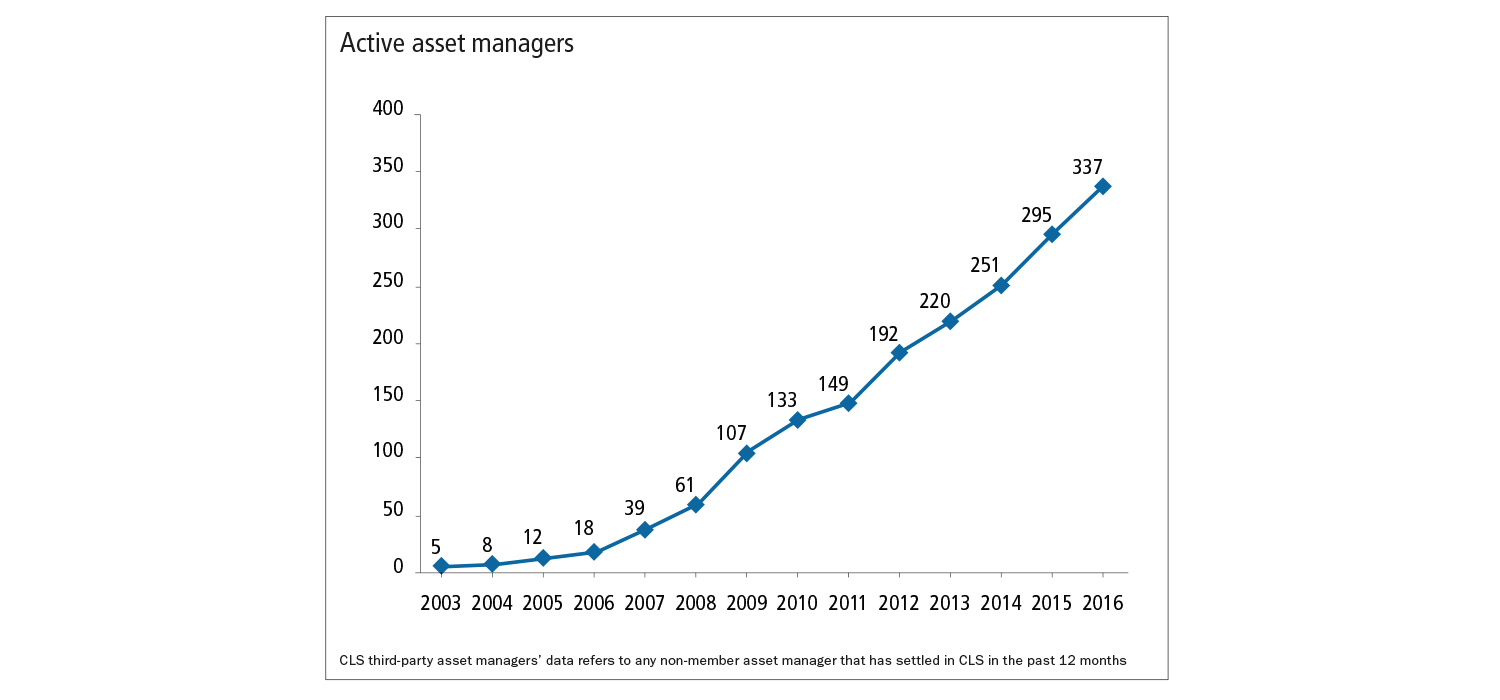

The CLS system has been widely adopted and promoted, by the asset management marketplace in particular. According to internal CLS statistics, in 2003 – just after CLS launched – five asset managers participated in CLS. By 2016 that number had increased exponentially to 337.

The statistics that suggest increased adoption of CLS speak for themselves. The rationale behind these statistics, however, warrants further discussion. Firstly, the traditional benefits of centralised settlement risk mitigation have become well established in the industry. In the early years of CLS, the case was still being made for the basic tenets of enhanced CLS protection – reduction of operational settlement risk, enhancement of STP, and the less time and fewer economic savings that accompany this. Nearly 15 years later, these basic benefits are well known, and accepted by the industry.1

As we head towards the midpoint of CLS’s second decade, asset managers and large funds are seeing the enhanced benefits of CLS’s PvP service for their FX settlement beyond these original tenets. One cannot begin this discussion without acknowledging that the trend towards asset globalisation and higher foreign content in domestic portfolios is increasingly prevalent, raising the profile and need for FX transactions and hedging within institutional portfolios. Yet, beyond the increased popularity of foreign investments and the traditional benefits of CLS, additional reasons and market trends have encouraged the adoption of CLS – establishing it as best practice for FX settlement.

CLS for currency management

While it is commonly understood that CLS may be utilised as a mechanism to mitigate settlement risk for deliverable FX forward transactions, the asset management space has also adopted the use of CLS for currency forwards that are being rolled so they can collect the profit and loss and forgo the actual intake of the deliverable currency. For those unfamiliar with the overall mechanics of CLS versus the manual settlement process, it is important to understand that when a trade is scheduled to be settled outside the CLS system it is confirmed with the bank counterparty at the time of execution. Further processing is then required prior to settlement to deliver those specific settlement details and instructions with the specific bank counterparty on the other side of the trade. However, when a trade is scheduled to settle via the CLS system, all necessary trade details are tagged at the time of the trade confirmation, and no further instructions are required prior to settlement.

The CLS process is centralised regardless of trading counterparty – unlike processes outside of CLS, which are often entity-specific. Although the risk of a mismatch of PvP exchange in the case of gross settlement is obviously not present in situations where a contract is rolled forward, the mechanics of the settlement tagging at the time of trade confirmation and preprocessing in advance of the settlement are just as applicable here. Additionally, asset managers will notice that operational efficiencies and STP benefits of CLS are still applicable for these operations. Accordingly, CLS has been further adapted for this extended use.

Broader counterparty rosters

A secondary reason for the increase in adoption of CLS is heightened market awareness of the benefits of counterparty diversification when considering counterparty risk and the pursuit of best execution. Settlements outside of CLS often require manual processes tailored to each counterparty bank for each settlement per bank and value date. Using CLS enables participants to employ a broad counterparty roster with greater ease. CLS allows for uniform processes, and requires no specific per-counterparty instructions in preparation for settlement. Including additional banks in a counterparty panel requires no additional workflow when settling via CLS. Accordingly, market participants can easily set up rosters of several counterparty banks when opting for settlement in CLS. This broader roster gives market participants the flexibility to pursue their own unique counterparty risk metrics and allows a fuller roster of banks to compete for each transaction.

Focus on best execution

The increased importance of achieving best execution – and the similarly increased scrutiny – of all components of transaction costs within the FX marketplace is another consideration. CLS allows execution agents to transact each trade more competitively, which can result in lower transaction costs. This is achieved by setting up a broader panel of counterparty banks, and allowing for true competition on each trade – even when a position is opened at one bank but is found to be more beneficial to close the position or roll it with a different bank. This is made possible by CLS allowing custodians to accommodate multilateral netting at a client level – rather than an individual bank level – directly when settlements occur, instead of across the CLS system.

When using CLS, custodian banks can allow clients to net their total required payments at the CLS level, not the bank counterparty or lower level. This results in broader option sets with each transaction. This option and opportunity for cost savings is also visible when positions must be moved from one bank counterparty to another. Again, when transactions settle via CLS, positions can be opened at one counterparty bank and closed at another without the additional layer of trading and costs. As new global regulations increase requirements around achieving best execution, the need for additional tools – such as CLS – becomes even more important to the marketplace.2

Further CLS considerations

While the benefits of CLS are undeniable, there are still a few matters institutions must consider in determining whether CLS is appropriate for them. First, a client’s individual custodian is the transacting party that makes settlement via CLS possible.

Often there are additional custodial charges for using CLS. This is dependent on the custodian and individual client package and agreement. However, custodians may choose to waive these fees, as they benefit from reduced operational risk. Custodial charges for CLS may also be quite nominal when compared with the pricing of CLS charges on the overall transaction price. However, it is a cost that should be evaluated.

Another factor to consider is that not all currencies are eligible for settlement in CLS. Accordingly, clients with both CLS and non-CLS currencies require two processes for settlement. Clearly, the wide spectrum of benefits will still be realised for CLS currencies, but plans and managers in such situations will have to accommodate two different processes – those for CLS currencies and those for non-CLS currencies.

Conclusion

Fifteen years since its inception, CLS has seen its adoption and acceptance rate grow. The additional benefits of CLS have raised awareness and demand among many institutional asset managers and clients who see CLS’s PvP settlement as part of their best practices in FX management. Some participants have gone so far as to make it a mandatory requirement in managing FX. The continued market trends of enhanced risk mitigation across an ever-broadening spectrum and further attention to counterparty selection, best execution and transaction costs make CLS’s role in the FX market increasingly important, now and in the future. As the FX market continues to evolve, CLS will continue to play a more central role for best-in-class operations.

1. Michael DuCharme 2008, CLS: The missing link in foreign exchange settlements.

2. Directive 2014/65/EU of the European Parliament and of the European Council of 15 May 2014 on markets in financial instruments and amending directive 2002/92/EC and directive 2011/61/EU (recast), 2014, OJ L 173/349, article 27.

About the author

Marisa Kurk is a senior managing director and chief operating officer for Mesirow Financial’s Currency Management Group.

Marisa has nearly 15 years of foreign exchange experience, delivering industry best practices to client portfolios, providing strategic risk management insights to clients, and managing specialised counterparty, legal and regulatory risks.

As chief operating officer, Marisa also oversees the functions of client service, including the provision of client reporting as well as client and prospect material. She received her Master’s degree in finance from DePaul University Kellstadt Graduate School of Business.

Marisa graduated with a BA in economics from Eastern Illinois University and was a member of the Departmental Honors Program for Economics.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com