LSE and Deutsche Börse deal collapses

EU commissioner Margrethe Vestager blocks merger attempt over monopoly concerns

The European Commission (EC) has blocked a merger between the London Stock Exchange Group (LSE) and Deutsche Börse (DB), after the two groups failed to address concerns raised by European Union commissioner Margrethe Vestager with respect to the creation of a monopoly in the clearing of fixed-income instruments.

More than a year since the announcement of the merger, the decision brings the attempt by the two giants to create Europe’s biggest exchange operator to an end. In the EC’s view, the

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact customer services - www.fx-markets.com/static/contact-us, or view our subscription options here: https://subscriptions.fx-markets.com/subscribe

You are currently unable to print this content. Please contact customer services - www.fx-markets.com/static/contact-us to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com

More on Exchanges

Moscow Exchange expands Asia and Middle East presence with Avelacom

Co-operation with tech firm lets exchange improve PoP in London, reducing latency by five milliseconds

Crypto to look more like FX market in 2019, says B2C2

Over-the-counter tipped to gain in importance, but faces funding and credit constraints, says cryptocurrency market-maker

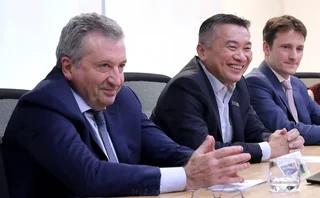

SGX snaps up 20% stake in BidFX

Exchange invests $25m in TradingScreen spinoff, expects to boost liquidity by adding OTC to FX futures

CBOE pulls plug on bitcoin futures trading

First mainstream exchange to offer bitcoin futures calls halt as it reviews approach to crypto

Independent Reserve joins OTCXN network

Australian crypto exchange joins to attract more institutional liquidity

CME to retire Nex, revives EBS as sub-brand

The deal between the two firms will go ahead after full regulatory approval in all jurisdictions

CME shifts FX options expirations in step with OTC

Latest move by exchange to make FX offering more harmonised and engaged with over-the-counter space

SGX’s Lam in bid to bring together two worlds

SGX set to launch FlexC FX Futures in August, with the aim of combining the best that OTC and futures have to offer